Is Your Project Covered? Navigating Allstate Home Improvement Insurance Claims sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Understanding what home improvement projects Allstate covers, navigating the claims process smoothly, and knowing the limitations and exclusions are key aspects we'll explore in this comprehensive guide.

Understanding Allstate Home Improvement Insurance Coverage

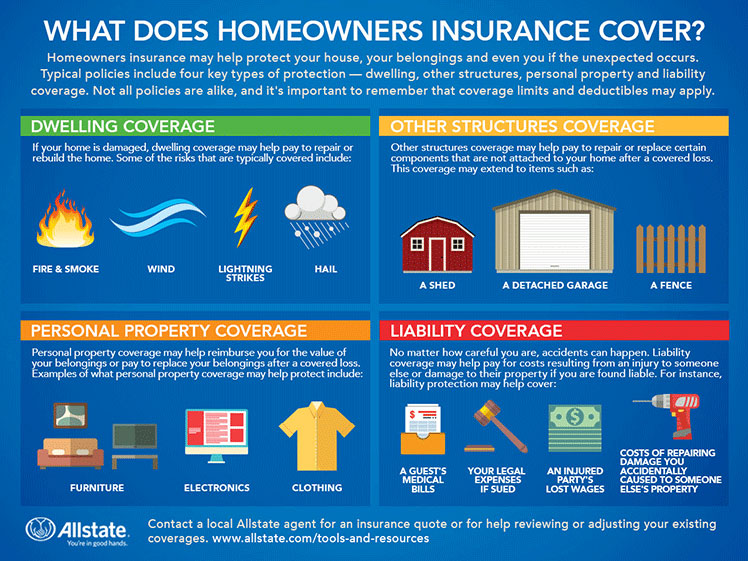

When it comes to Allstate home improvement insurance coverage, it's important to understand what types of projects are covered and how to determine if your project is eligible for coverage.Types of Home Improvement Projects Covered

- Allstate typically covers a wide range of home improvement projects, including kitchen and bathroom renovations, roof repairs, HVAC upgrades, and more.

- Structural improvements, such as adding a new room or extension, may also be eligible for coverage.

Determining Eligibility for Coverage

- Before starting your home improvement project, it's essential to review your Allstate insurance policy to understand what is covered.

- Contact your Allstate agent to discuss your project and determine if it meets the criteria for coverage.

Common Home Improvement Claims Covered by Allstate

- Water damage from a leaky roof or burst pipe is a common claim that Allstate typically covers.

- Damage from natural disasters, such as storms or wildfires, may also be covered under your Allstate home insurance policy.

Navigating the Claims Process

When it comes to filing a home improvement insurance claim with Allstate, there are specific steps you need to follow to ensure a smooth and efficient process. Proper documentation and evidence are crucial to support your claim and get the coverage you deserve.

When it comes to filing a home improvement insurance claim with Allstate, there are specific steps you need to follow to ensure a smooth and efficient process. Proper documentation and evidence are crucial to support your claim and get the coverage you deserve.

Steps to File a Home Improvement Insurance Claim with Allstate:

- Contact Allstate: Notify your insurance agent or Allstate's claims department as soon as possible after the damage occurs.

- Evaluate the Damage: Take photos or videos of the damage to provide visual evidence.

- Documentation: Gather all relevant documents, including receipts, contracts, and any other supporting evidence.

- File the Claim: Submit the necessary paperwork and documentation to Allstate to initiate the claims process.

- Assessment: An adjuster will be assigned to assess the damage and determine the coverage amount.

- Repair Process: Once the claim is approved, you can proceed with the repair or home improvement work.

- Follow-Up: Stay in touch with your Allstate claims representative for updates on the progress of your claim.

Tips for a Smooth Claims Process:

- Act Quickly: Report the damage promptly to expedite the claims process.

- Be Thorough: Provide detailed information and documentation to support your claim.

- Communicate Clearly: Keep open communication with your Allstate representative throughout the process.

- Follow Instructions: Adhere to any guidelines or requests from Allstate to ensure a successful claim.

Required Documentation for Home Improvement Insurance Claims:

- Receipts: Keep all receipts related to the home improvement project for reimbursement purposes.

- Contracts: Provide copies of any contracts or agreements with contractors for the work done.

- Photos/Videos: Visual evidence of the damage and repair work can support your claim.

- Estimates: Obtain written estimates for the repair costs to submit with your claim.

Coverage Limitations and Exclusions

When it comes to Allstate home improvement insurance coverage, it's essential to understand the limitations and exclusions that may apply. By being aware of these factors, homeowners can take steps to maximize their coverage and minimize out-of-pocket expenses.Potential Limitations on Coverage

- Some home improvement projects may have limitations on coverage based on the type of work being done. For example, cosmetic upgrades like painting or wallpapering may have lower coverage limits compared to structural renovations like adding a new room or replacing the roof.

- Additionally, certain high-risk projects such as swimming pool installations or major landscaping changes may require additional coverage or have limited coverage under a standard Allstate policy.

- It's important to review your policy carefully and discuss any planned projects with your insurance agent to understand the coverage limitations that may apply.

Common Exclusions

- Common exclusions from Allstate home improvement insurance coverage may include pre-existing damage, wear and tear, and maintenance-related issues. These are typically considered the homeowner's responsibility and may not be covered by the insurance policy.

- Other common exclusions may involve damage caused by neglect or improper maintenance, as well as damage resulting from natural disasters such as floods, earthquakes, or hurricanes. Additional coverage may be needed for these types of situations.

- Understanding these exclusions can help homeowners make informed decisions about their insurance coverage and take steps to address any potential gaps in protection.

Working With Contractors and Allstate

When it comes to navigating Allstate home improvement insurance claims, working effectively with contractors is crucial for a successful outcome. Contractors play a vital role in the claims process as they are responsible for assessing damages, providing estimates, and carrying out the necessary repairs or renovations. Here are some tips on how to work with contractors approved by Allstate and coordinate with both the contractor and the insurance company.Selecting Reputable Contractors Approved by Allstate

- Check for certifications: Look for contractors who are certified by Allstate or have a good track record of working with the insurance company.

- Read reviews: Research online reviews and ask for references to ensure the contractor has a positive reputation and a history of delivering quality work.

- Verify insurance coverage: Confirm that the contractor has liability insurance and workers' compensation coverage to protect you in case of accidents or damages during the project.

Coordinating with Contractor and Allstate for a Successful Project

- Open communication: Maintain open communication with both the contractor and Allstate throughout the project to ensure everyone is on the same page regarding timelines, costs, and expectations.

- Provide documentation: Keep detailed records of all communication, contracts, invoices, and receipts to facilitate a smooth claims process and avoid any misunderstandings.

- Follow guidelines: Adhere to Allstate's guidelines and requirements for the claims process, including obtaining approval for repairs and submitting necessary documentation promptly.

Last Point

In conclusion, navigating Allstate Home Improvement Insurance claims can be a seamless process when armed with the right knowledge. By understanding coverage, the claims process, limitations, and working effectively with contractors, homeowners can ensure their projects are well-protected.

FAQ Corner

What types of home improvement projects are covered by Allstate insurance?

Allstate typically covers projects like kitchen renovations, bathroom remodels, and roof replacements. Contact Allstate for specific details on your project.

How can I ensure my home improvement insurance claim with Allstate is processed smoothly?

To ensure a smooth process, provide all necessary documentation, communicate clearly with Allstate, and follow up regularly on the status of your claim.

What are common exclusions that may not be covered by Allstate insurance for home improvement projects?

Common exclusions include pre-existing damages, non-permitted work, and wear and tear. Review your policy details for specific exclusions.

How can I select reputable contractors approved by Allstate for my home improvement project?

Check Allstate's list of approved contractors, ask for references, and ensure they are properly licensed and insured before hiring.